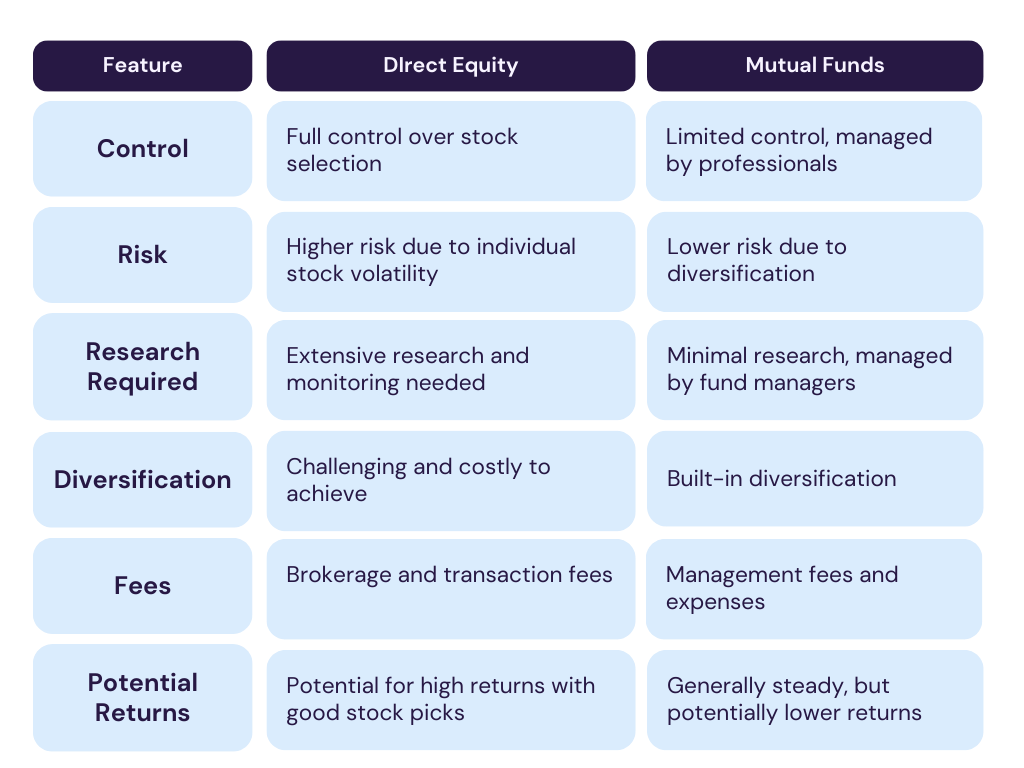

Investing in the stock market can be done through various means, with direct equity and mutual funds being two of the most popular options. Here are the key differences between them:

Definition: Direct equity involves purchasing shares of individual companies directly on the stock exchange.

Definition: Mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities, managed by professional fund managers.

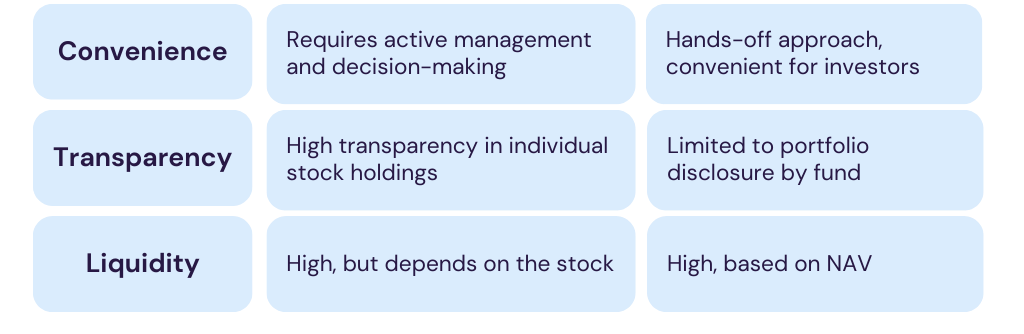

Choosing between direct equity and mutual funds depends on your investment goals, risk tolerance, time commitment, and expertise.

For many investors, a combination of both direct equity and mutual fund investments can provide a balanced approach to building wealth in the stock market.

TTA – A Stock market institute.TTA is one of the best stock market institutes in Rajkot. If you want to become a Navratna Trader you can enroll Advance course you will get basic to advanced knowledge of Hedging Strategy.