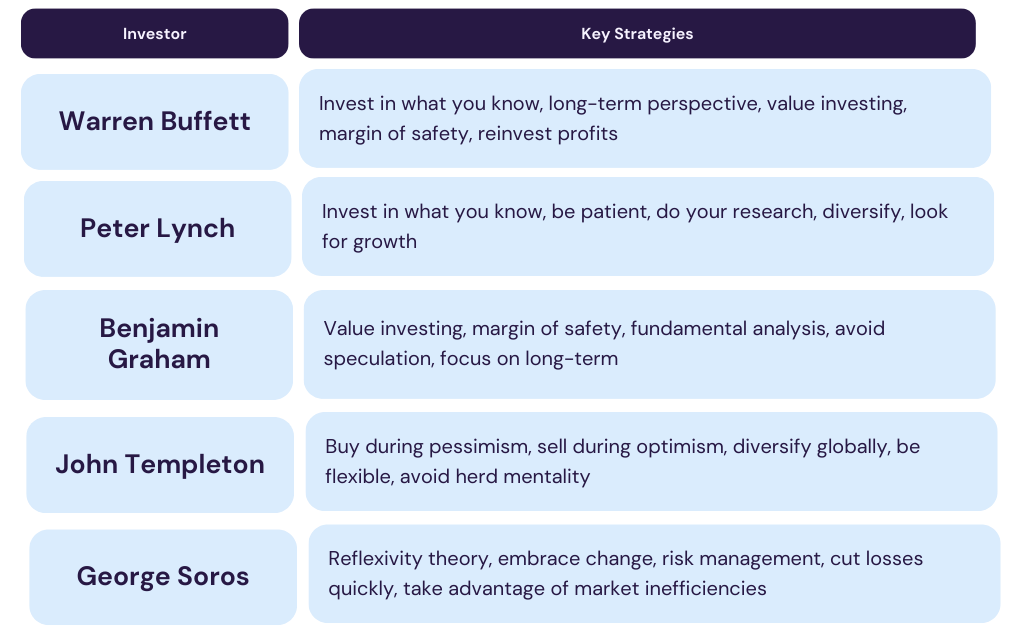

The stock market has seen many successful investors who have made significant fortunes and impacted investment strategies globally. Here are the top five investors and their golden rules:

Each of these top investors has developed a unique approach to investing in the stock market, but common themes such as understanding investments, managing risk, and focusing on long-term growth emerge. By following these golden rules, investors can learn valuable lessons to enhance their own investment strategies.

TTA – A Stock market institute.TTA is one of the best stock market institutes in Rajkot. If you want to become a Navratna Trader you can enroll Advance course you will get basic to advanced knowledge of Hedging Strategy.